The City of Colorado Springs just passed its 2024 budget. So, what’s in a City budget, how does it work and who’s in charge of putting it together?

The Mayor is responsible for crafting the budget each year, and the nine-member City Council reviews and votes to make any changes before passing it. Of course, the reality of what goes into that process is a lot more complex. So let’s use this year’s budget to help explain.

Just like when you create your family budget, the City needs to understand how much money it expects to have and what it needs to pay for in the coming year. In 2024, City revenue – funds the City takes in – is expected to stay flat, but costs have gone up. So it will cost more to provide the same services, but there isn’t more money to cover those costs. And unlike at the federal level, the City’s budget must be balanced in accordance with the City Charter.

Finding a way to do more with less

Mayor Yemi Mobolade worked with City department leaders to prioritize the most important needs. The 2024 budget contains several cost-saving measures, including a 3.4% cut to all department’s operating expenses. Each director found different ways to implement these savings with the least impact to the public. The budget also includes a one-time judicious use of $10 million of reserve funds, which is also known as a rainy-day fund, to help lessen operational cuts.

A good example of smart savings that allow the City system as a whole to do more with less is how the Police and Fire departments handled their reductions. Public safety is the City’s No. 1 priority. So these departments made cuts to one-time nonessential spending that will not affect the safety of residents. For instance, the Police Department made changes to a planned expansion of the impound lot.

Other examples of key services not impacted are paving roads, filling potholes, plowing roads, maintaining parks, building stormwater systems so the City doesn’t flood, supporting affordable housing, and on and on.

As Mayor Yemi said in delivering the budget to Council, “By working together, we found the areas of least impact so that we can and we will continue to deliver for our residents.”

How does this year’s budget prioritize spending?

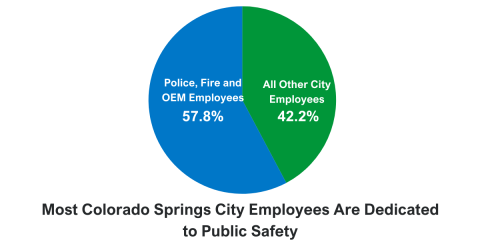

A great example of how the 2024 budget prioritizes spending is the 4% salary increases for all sworn Police and Fire employees and those in the Emergency Communication Center. This is critical for public safety by helping keep employees, so we have enough officers and staff to respond to our community’s needs. Fun fact – nearly 60% of City employees work for either Police, Fire or the Office of Emergency Management.

The 2024 budget also for the first time fully funds the Homeless Outreach Program in the Fire Department. This program, that was previously funded by grants, provides intensive outreach work with individuals experiencing homelessness who are vulnerable and exhibit high-acuity behaviors. There is also funding for continued replacement of Police and Fire department emergency vehicles and traffic safety changes to allow for the installation of school zones at middle and high schools citywide.

Investing in infrastructure – like roads, bridges, sidewalks, parks and trails – is another critical part of the City budget. The Parks, Recreation & Cultural Services Department received funding for a host of projects, including the planning and implementation of Grey Hawk Park and Fisher Canyon Open Space, along with Legacy Loop trail connections, numerous irrigation, signage, and other planning projects. Public Works received $1.9 million of matched funding to leverage $15.4 million in grant funding for critical infrastructure and transportation-related capital projects. That is an example of using City dollars in a creative way to do more for residents with less money.

Where does the City’s money come from?

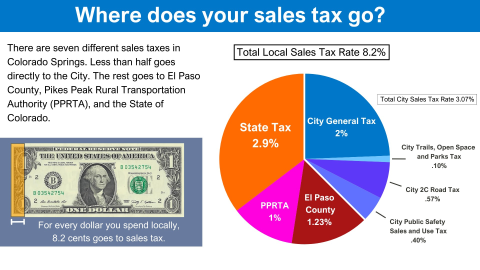

The City collects revenue through sales and use tax, property tax, fees and other sources. Sales and use tax is the largest chunk of funding, and it is dependent upon the level of local economic activity, consumer confidence, tourist activity and inflationary growth. So, if residents or tourists start spending less money, the City’s revenue is impacted. That is what happened in 2023.

In 2023, City sales tax revenue flattened, and, in some months, it declined. That trend is expected to continue into 2024, with only a small, anticipated increase compared to the previous year.

And the City doesn’t get all the local sales tax that residents pay. While total local sales tax is 8.02%, the City directly receives less than half of that (3.07%). The rest goes to El Paso County, the Pikes Peak Rural Transportation Authority, and the State government.

The main source of funding for the City budget is called the “general fund.” That is the funding that the Mayor has the most control over how to spend. The Mayor can shift that funding around to meet the priorities for the upcoming year. In 2024, the General Fund is $428 million.

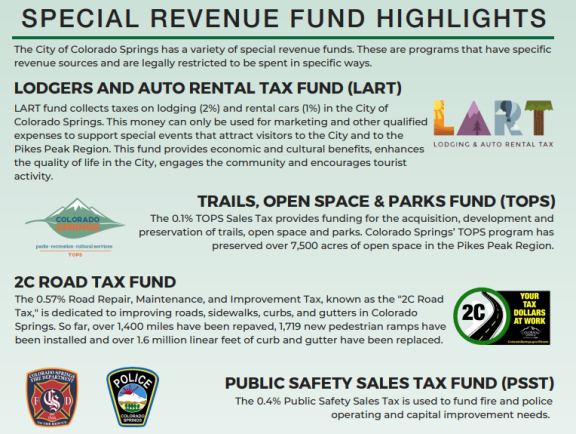

There is also City tax that by law can only be spent on specific areas. An example is 2C funding, a 0.57% sales and use tax that was approved by voters that only goes toward fixing roadways. The City also has several enterprises that have their own dedicated revenue that they can only spend on themselves. The Airport is a good example of an enterprise that has its own revenue that it can only spend on Airport needs. These enterprises cannot receive money from the General Fund.

The City also receives a portion of local property tax. Because of new property assessments, property taxes for many have increased. To provide relief, the City is expecting to give back over $6 million to residents in 2024 by capping your local property tax rate. This will also ensure the City does not exceed its Taxpayer Bill of Rights (TABOR) limit.

A budget creates a roadmap to a better future

The budgeting process is transparent and open to public input. The proposed budget is posted in October, and residents can attend City Council meetings to learn about the priorities and provide input. This participatory approach not only gives a voice to residents, it also ensures that the budget truly reflects the diverse needs and aspirations of the community.

Colorado Springs has about 500,000 residents living in 200 square miles of land, driving on over 6,500 lane miles of roadway, and having fun in over 9,000 acres of parkland and 500 acres of trails. It’s the job of the budget to set a roadmap to make the most of that money. By investing in the very arteries that connect our neighborhoods, the City paves the way for smoother commutes, safer communities, and a more sustainable future.