Business Personal Property Tax Incentive Program

Businesses pay City business personal property tax (BPPT) on equipment used to conduct business; for example, large machinery, computer equipment, desks, and furniture -- anything that is not permanently affixed to the real property. Primary employers may qualify for an incentive based upon the City's portion of BPPT paid. This amount could be either 50% or 90% of business personal property taxes paid, depending upon the number of new jobs created and the amount of investment in business personal property.

Under the City's BPPT program, standard agreements are for a four-year term and require the company to create at least 10 new jobs and have over $1 million in business personal property value. For a 10-year agreement, the company must create at least 100 jobs in addition to the $1 million investment, and if the company creates over 500 jobs and invests over $75 million, the City may extend a 10-year agreement for an additional five years to a maximum of 15 years.

Program Eligibility:

This program is available to primary employer companies. A primary employer is a business entity that derives at least 50% of its principal source of gross annual income from the sale of products or services outside of El Paso County. The program provides an incentive payment of either 50% or 90% of the City of Colorado Springs business personal property taxes paid, based on the amount of the investment as determined by the El Paso County-assessed market value of business personal property, over the term of the agreement years. Companies must hire at least 10 employees and invest at least $1 million in business personal property to qualify for the program.

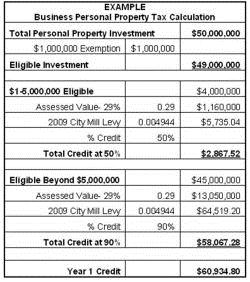

Incentive Calculation:

Incentives are calculated and issued as follows.

For investments:

- Less than $1,000,000 of personal property value, no incentive is available

- Over $1 million and up to $5 million, an incentive of 50% of City taxes paid is available

- Over $5 million and up, an incentive of 90% of City taxes paid is available

Claiming an Incentive:

The company must have a current agreement with the City of Colorado Spring and request its incentive annually.

The company must provide:

Business personal property tax statements from El Paso County

- Proof of taxes paid

- Documentation supporting job creation

Issuing the Incentive:

Assuming job creation and financial investment requirements are achieved in the first year the BPPT agreement was executed, a company can expect its first incentive payment two years later. For example: BPPT agreement executed in 2009; El Paso County assesses business personal property value in 2010; the business pays respective taxes, files for incentive, and receives incentive in 2011.