The next General Municipal Election will be held on April 6, 2027 for the offices of Mayor and the three At-Large City Council seats.

The November 4, 2025 general election will be conducted by the El Paso County Clerk and Recorder. Please contact their office for more information.

Voter Resources

Register to Vote / Update Voter Information

The City Clerk does not maintain voter registration.

Register online at the Colorado Secretary of State.

Questions? Visit El Paso County Elections or call (719) 575-8683.

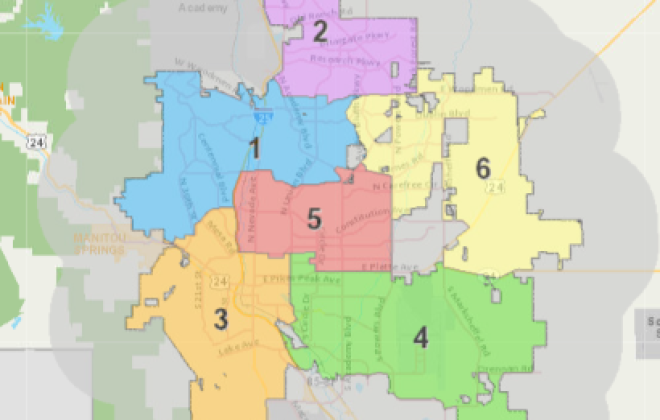

What City Council District do I reside in?

In 2024, the six city council district boundaries were all redrawn to accommodate the population growth across the city. To find a list of the current City Council members and in which council district your residential address is located and district maps, and other data related to City Council , please visit our interactive district map.

Military and Overseas Voting (UOCAVA)

Are you a Colorado voter currently residing outside of the United States? Get information on how to vote.